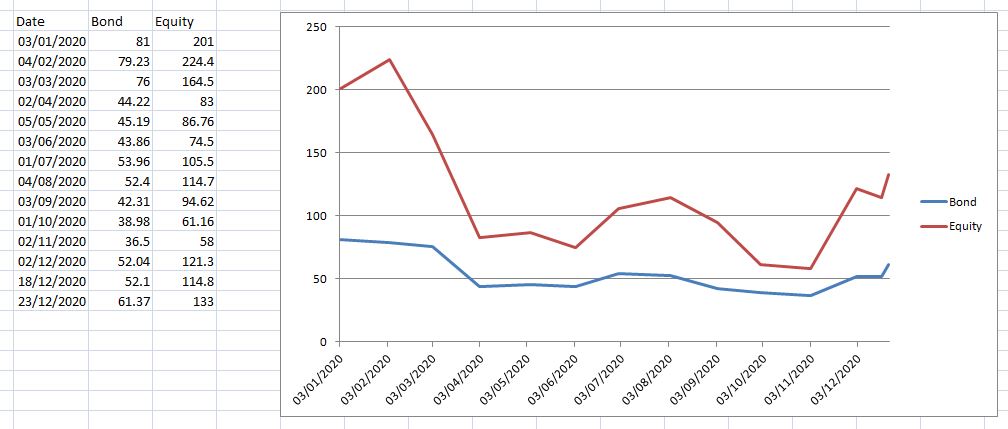

I've just done a quick comparison of bond prices for Metro Bank from this source data for bonds and this source data for equity. Here are the absolute values each month of this year. (Bond prices in Blue, Share price in Red)

Setting both to start at 100 makes it relatively more interesting. It seems that the bond prices are leading the equity prices over the whole year. Bonds are 76% of their value from the begining of the year whilst shares are only 66% of their value from the start of the year.

Is the equity on track to close the gap? 76% of the value of the share price at the begining of the year would be 153p. It looked like it was trying to make it on Monday afternoon.

I own shares in Metro Bank. This is not investment advice. Please do your own research. I'm happy to share mine.

Comments

Post a Comment